An Overview Form 1095-B: Health Coverage

ACAwise, a customized ACA Reporting solution, generates ACA

Form 1095-B and e-files them with the IRS / State and distributes employee copies. Learn More

ACA Form 1095-B - An Overview

- Updated October 05, 2023 - 8.00 AM by Admin, ACAwiseWhen the Affordable Care Act (ACA) was passed, the IRS designed Section 6055 of the Internal Revenue Code as a way to gather information on the health insurance coverage that is being offered to individuals.

Under IRC Section 6055, the IRS requires health coverage providers including insurers and small employers to file ACA Forms 1095-B and 1094-B to the IRS and distribute copies of ACA Forms to their employees.

The following instructions summarize what employers must know about the ACA Form 1094-B and Form 1095-B filing requirements.

Table of Contents

- What is the purpose of ACA Form 1095-B?

- Who must file ACA Form 1095-B?

- Information that is required to file ACA Form 1095-B

- Updates to 2024 Form 1095-B Filing

- What is the deadline to file ACA Form 1095-B?

- How to File ACA Form 1095-B?

- How to file an Extension of time to file ACA Form 1095-B?

- What is the penalty for failure to file or furnish ACA Form 1095-B?

- Where do I mail ACA Form 1095-B?

- Meeting your 2024 ACA Form 1095-B Reporting Requirements

What is the purpose of ACA Form 1095-B?

Form 1095-B is used to report health coverage information to the IRS regarding individuals who are covered by minimum essential coverage.

Eligibility for certain types of minimum essential coverage can affect a taxpayer's eligibility for a premium

tax credit.

Who must file ACA Form 1095-B?

Every person that provides minimum essential coverage to an individual during a given calendar year must file an information return reporting this coverage.

Government employers that offer employer-sponsored self-insured health coverage to non-employees may use Form 1095-B, rather than Form 1095-C, Part III, to report coverage for their enrolled individuals and their family members.

Small employers, with less than 50 full-time and full-time equivalent employees, aren't subject to the employer shared responsibility provisions. However, any small employers who sponsor self-insured group health plans must use Forms 1094-B and 1095-B to report information about their covered individuals.

Filers must use transmittal Form 1094-B to submit Forms 1095-B.

Information required to file ACA Form 1095-B

The following information is needed when filing ACA Form 1095-B

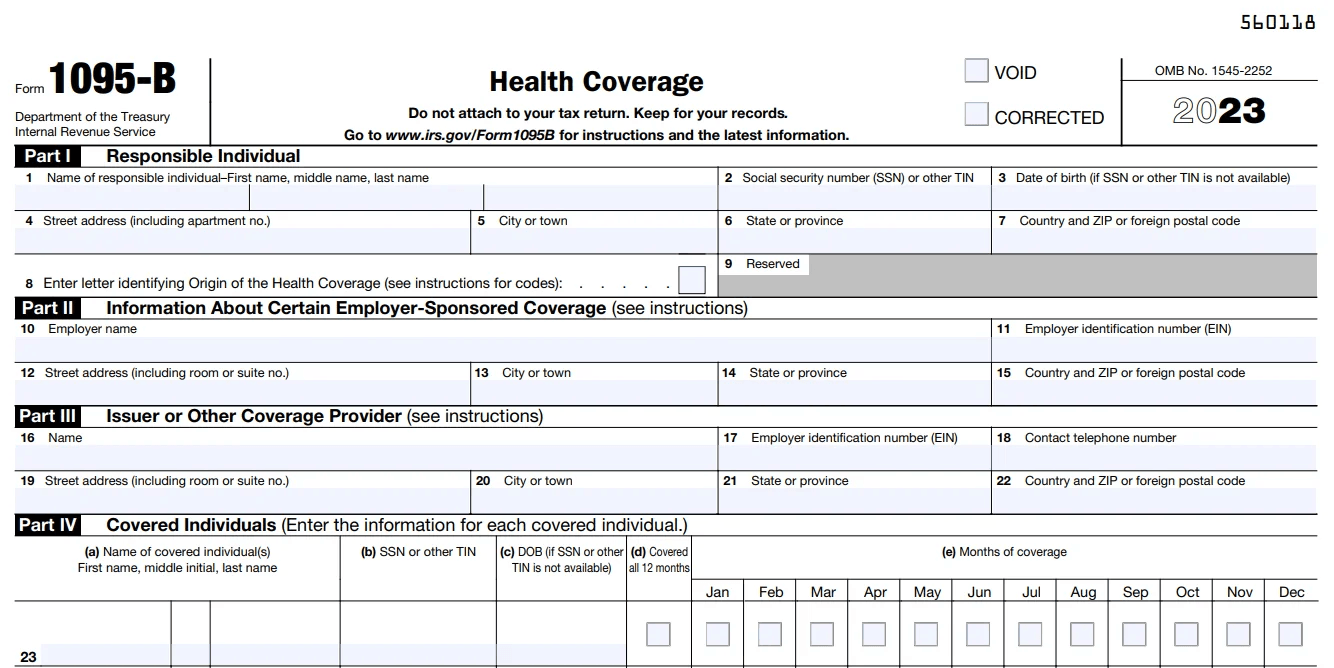

Part I, Responsible Individual

- The individual’s basic information such as their Name, SSN, Date of Birth, Address

Part II, Information About Certain Employer-Sponsored Coverage

- The employer’s basic information such as their Name, SSN, Date of Birth, Address

Part III, Issuer or Other Coverage Provider

- The Issuer’s basic information such as their Name, SSN, Date of Birth, Address

Part IV, Covered Individuals

-

This part indicates which months you and/or your family member(s) were enrolled in coverage for any day in a particular month

- The covered individual’s details such as their Name, SSN, month of coverage offered

Updates to 2024 Form 1095-B Filing

In the month of October, the IRS has released a final version of the ACA Forms for 2024 ACA reporting, which clearly indicates that there are no changes or additions to the 1095 codes.

While there were no major changes to ACA forms and their respective ACA 1095 codes during the tax year, the IRS did update the ACA affordability percentage for the 2023 tax year.

- The affordability percentage for the 2023 tax year is 9.12%.

- The IRS reduces the e-filing threshold to 10 returns. i.e., if you are filing 10 or more returns, it is mandatory to e-file them.

- Also, the IRS has increased the penalty amount for employers and health coverage providers who fail to complete their ACA reporting on time. Check out the updated penalty amounts.

What is the deadline to file ACA Form 1094 and 1095-B

Any health coverage providers who offer minimum essential coverage to an individual should furnish a copy of ACA Form 1095-B to the individuals by March 01, 2024, for the 2023 calendar year.

Health Coverage Providers must also file ACA Forms 1094-B and 1095-B to the IRS by April 01, 2024, if you choose to file electronically. The Form should be filed by February 28, 2024, if filing on paper.

Click here for the state filing deadlines.

How to File ACA Form 1095-B?

The ACA Form 1095-B can be filed either electronically or by paper with the IRS.

However, the IRS encourages organizations to file electronically. By E-filing, the IRS can process your returns at a faster rate and you can learn the status of your submission instantly.

Choose an Electronic filing method for quick, secure, and more accurate filing. E-file ACA Form 1095-B Now

If you choose to paper file ACA Form 1095-B, download the ACA Form 1095-B, fill in the necessary details, and then send it to the IRS by the address mentioned here.

How to file an Extension of time to file ACA Form 1095-B?

Health Coverage Providers can get an automatic 30-day extension of time to file by filing Form 8809.

The extension form may be submitted on paper, or electronically. No signature or explanation is required for the extension.

However, you must file Form 8809 on or before the original deadline of the return to get the 30-day extension.

What is the penalty for failure to file or furnish ACA

Form 1095-B?

The penalty for filing & furnishing ACA Forms with an incorrect ACA information return is $280 for each return for which the failure occurs, with the total penalty for a calendar year not to exceed $3,392,000.

Click here to learn about ACA penalties.

Relief Regarding Form 1095-B for 2023

When it comes to Form 1095-B, the IRS is not penalizing organizations for failing to provide recipient copies under two conditions.

- First, the employer must make it abundantly clear on its website that the 1095-B is available

upon request. - Second, the recipient copy must be supplied within 30 days to the individuals who do make

this request.

Both of these conditions must be met.

See Notice 2020-76 and Information Reporting Penalties.

Where do I mail ACA Form 1095-B?

| Business Location | Mailing Address |

|---|---|

| Alabama, Arizona, Arkansas, Connecticut, Delaware, Florida, Georgia, Kentucky, Louisiana, Maine, Massachusetts, Mississippi, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, Texas, Vermont, Virginia, West Virginia |

Department of the Treasury Internal Revenue Service Center Austin, TX 73301 |

| Alaska, California, Colorado, District of Columbia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Maryland, Michigan, Minnesota, Missouri, Montana, Nebraska, Nevada, North Dakota, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Utah, Washington, Wisconsin, Wyoming |

Department of the Treasury Internal Revenue Service Center P.O. Box 219256 Kansas City, MO 64121-9256 |

Meeting your 2024 ACA Form 1095-B Reporting Requirements

Choose the right ACA Reporting vendor like ACAwise to take care of e-filing your ACA Form 1095-B.

ACAwise is a comprehensive ACA reporting solution provider that can help you to get started with your

ACA reporting now.

ACAwise helps to e-file your ACA Form 1095-B with the IRS, State and distribute the 1095 copies to your employees on-time. ACAwise is equipped to handle special scenarios such as ICHRA, COBRA, Rehire, terminated, etc.

We provide two different ACA reporting services for you to choose from, based upon your requirements.

Interested in ACAwise?

Send us your requirements to [email protected] or give us a call at (704)-954-8420.

You can Sign Up Now and add your basic business details to begin your ACA reporting.

One of our ACA Representatives will contact you with a free consultation and quote.

A Quick Guide for Employers

ACAwise has created a Free guide to help applicable large employers to know 2024 ACA Reporting Requirements

and ACA Codes better.