When should I file an ACA correction Form?

Correction Forms must be filed immediately

-

When the IRS notifies you of any errors

- Accepted with Errors

- Partially-Accepted

- Not Found

- Rejected

- When you identify any errors on Forms 1095-B or 1095-C or Transmittal Form 1094-C

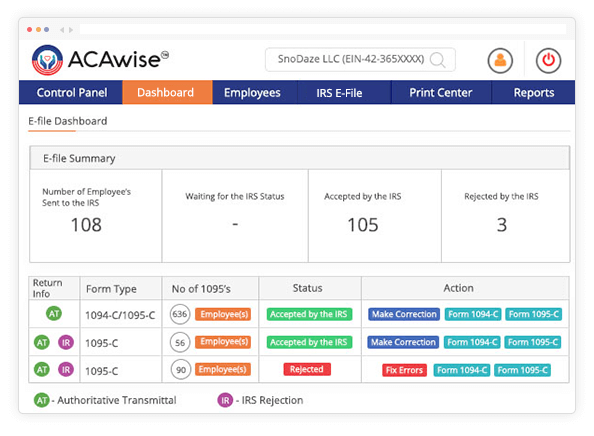

Reporting Corrections using ACAwise

Correcting Errors Reported by IRS

Will the IRS accept my ACA returns with errors?

Contact ACAwise now! We will keep you informed of any errors and assist correcting & retransmitting the returns.

Amend your Form with Updated Information

Need to correct your employee's coverage information or report more 1095 Forms?

No problem! ACAwise allows you to correct, update and amend your Transmittal Form 1094.

ACAwise supports Form 1094/1095 corrections for up to 3 prior years

How to Correct your ACA 1094, 1095 Forms using ACAwise?

Sign In and upload your corrected File

Notify ACAwise team for the correction

ACAwise will process your file, regenerate the corrected forms, and notify you for further review

Finally, ACAwise will retransmit it to the IRS and mail copies to employees

Noticed errors? Filing correction is simple and easy now with ACAwise.

What information can you correct on your ACA 1094, 1095 Forms?

Authoritative Transmittal Form 1094-C

- ALE Member or Designated Government Entity (Name and/or EIN)

- Total number of Forms 1095-C filed by and/or on behalf of ALE Member

- Aggregated ALE Group Membership

- Certifications of Eligibility

- Minimum Essential Coverage Offer Indicator

- Section 4980H Full-Time Employee Count for ALE Member

- Aggregated Group Indicator

- Other ALE Members of Aggregated ALE Group (Name and/or EIN)

ACA Form 1095-C

- Name, SSN, ALE Member EIN

- The offer of Coverage (line 14)

- Employee Required Contribution

- Section 4980H Safe Harbor and Other Relief Codes (line 16)

- Covered Individuals Information

ACA Form 1095-B

- Name of responsible individual

- Origin of the Health Coverage

- SSN or TIN

- Employer-Sponsored Coverage Information

- Issuer or Other Coverage Provider Information

- Covered Individuals