Understanding ACA Automation

Automating the ACA filing process allows you to skip the hassles of manual work, enhancing efficiency.

Here is how ACA Automation works with our API:

- Send the required 1094/1095 form data from your software, including the ACA codes, to our API.

- Let our API generate your ACA Form 1095-B / 1095-C, along with the transmittal Form 1094-B / 1094-C, based on the data provided.

- Once previewed, automate the e-filing of ACA Forms with the IRS and State. You can check the status of the forms from your software.

- You can distribute the recipient copies via Postal Mailing or Online Access.

Why Should You Integrate Our API with Your Software for ACA Automation?

- Seamless Integration - You can integrate our API seamlessly with your existing software.

- Easy Preparation & Filing - Just provide the form data and leave the preparation and efiling part to us.

- Data Validations - Our API performs basic data validations to ensure the accuracy of your ACA returns.

- Federal and State Filing - With our API, you can take care of both federal and state ACA compliance.

- Recipient Copy Distribution - Distribute the ACA form copies to your recipients via Postal Mail or Online Access.

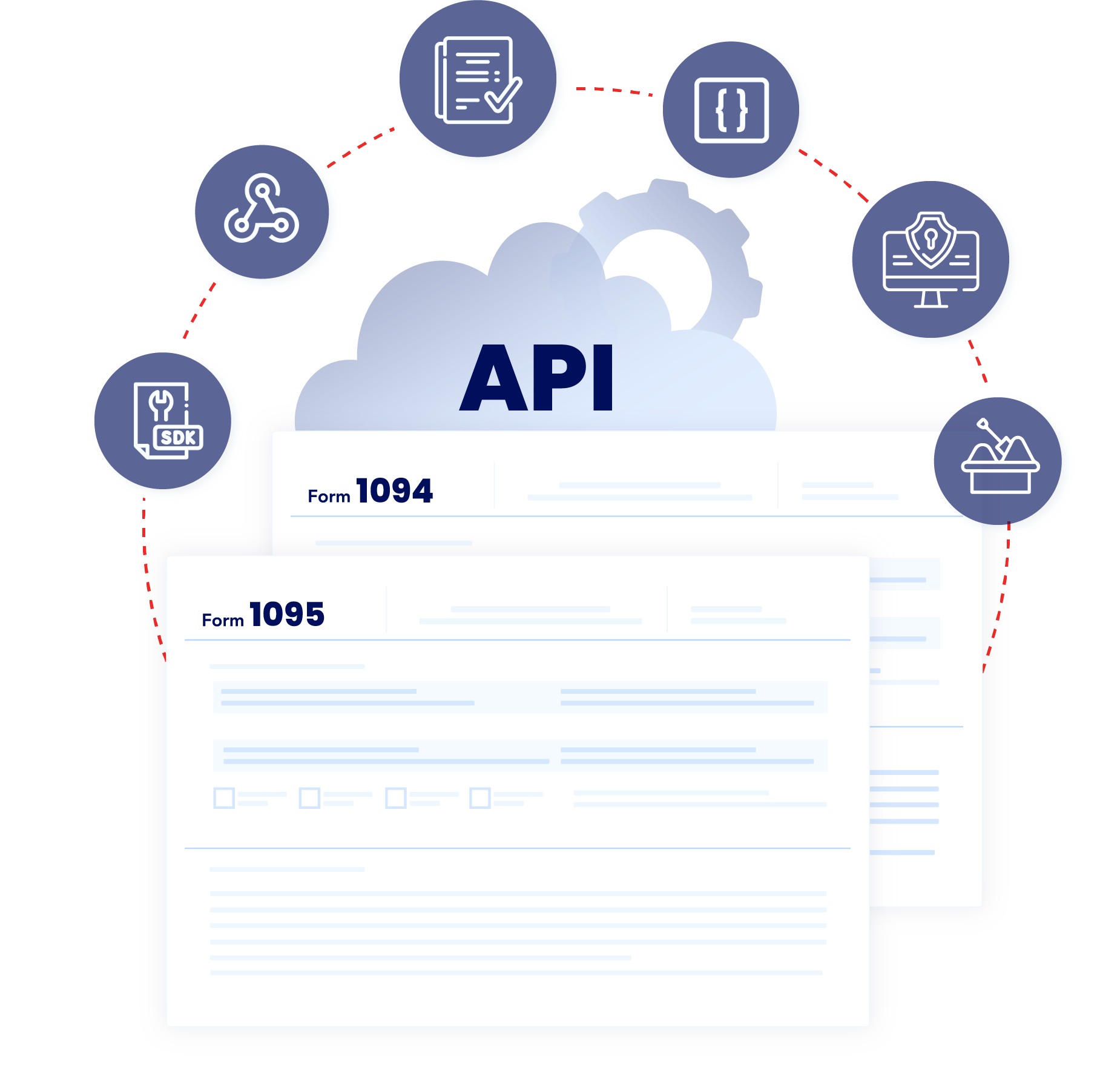

Reliable Tools & Resources to Develop with Confidence!

Clear Documentation

Our documentation comprises detailed instructions for each endpoint, helping you understand how our API works.

Open SDKs

We have open Software Development Kits (SDKs) available in Java, Node JS, .Net, PHP, and Python, explaining how to use our API.

Sandbox

Using our Sandbox environment, you can develop and test the integration securely. You can simulate the entire e-filing process as well.

Webhooks

Through Webhooks, our API can provide you with updates on the status of tax forms filed with the IRS.

Advanced Security

Our API is HIPAA-compliant and incorporated with standard security measures to ensure complete protection of data.

Developer Support

We have a team of developers available to address your questions instantly, if any.