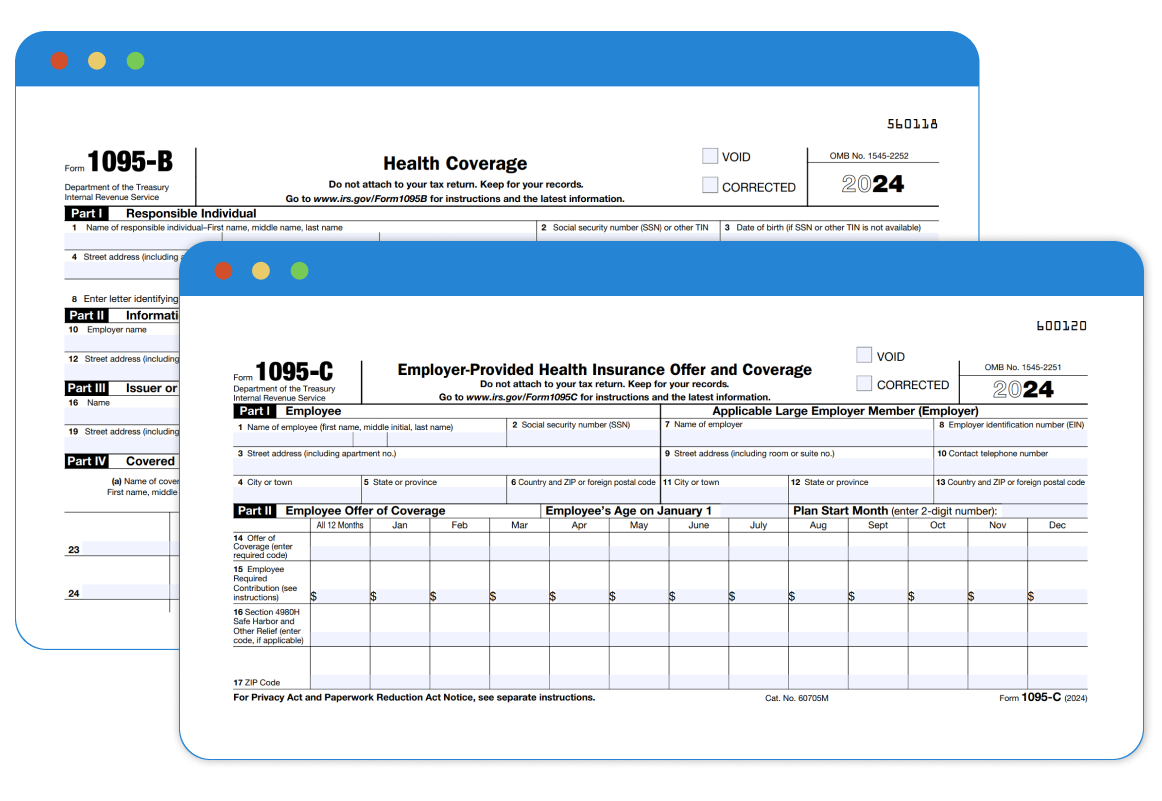

2024 ACA Form 1095-B and 1095-C Changes

The IRS Issued a Final Version of 2025 ACA Forms 1095-B and 1095-C

- Updated November 05, 2024 - 8.00 AM by Admin, ACAwiseThe IRS issued a Final Form 1095-B/1095-C for 2025 ACA reporting.

Like every year, this year also the IRS has updated its ACA forms to improve the reporting of employees' health coverage information.

So, before initiating the process of your ACA Reporting for 2025, you must be aware of the changes in the Form and the deadline.

What's new in 2025 ACA 1095-B/C?

From the final version of 1095-C and Form 1095-B, it is clear that there is no addition of codes or changes for 2024 ACA reporting.

New E-filing Requirements for 1095-B/C Forms

The electronic-filing threshold for information returns has been decreased to 10 for 2024 tax year. If your business has 10 or more returns, then you need to e-file your ACA forms with the IRS. This means even the smallest businesses will need to e-file.

ICHRA Affordability:

- Based on the federal poverty line percentage, the IRS has set the ICHRA affordability percentage for the 2024 tax year as 8.39%.

Penalties:

- Under Section 4980H(a) - the penalty rate is $2,970 for the tax year 2024

- Under Section 4980H(b) - the penalty rate is $4,460 for the tax year 2024

- Learn more about ACA Penalties.

Deadline:

There are slight changes to ACA filing deadlines this year since the actual deadlines fall on a weekend. However, the deadline to provide recipients with copies of ACA forms remains distinct. Adhering to these deadlines is essential to avoid significant penalties.

Choose ACAwise to Simplify your ACA Reporting in 2025

If you’re looking to comply with the 2025 ACA reporting requirements, contact our ACAwise experts. We have years of experience in handling the ACA Reporting process accurately and securely.

We offer customized services based on your reporting needs to maintain IRS and State compliance. We also offer a solution for TIN Matching, printing, and mailing your recipient copies as well.

Know more about our services.

A Quick Guide for Employers

ACAwise has created a Free guide to help applicable large employers to know 2025 ACA Reporting Requirements

and ACA Codes better.